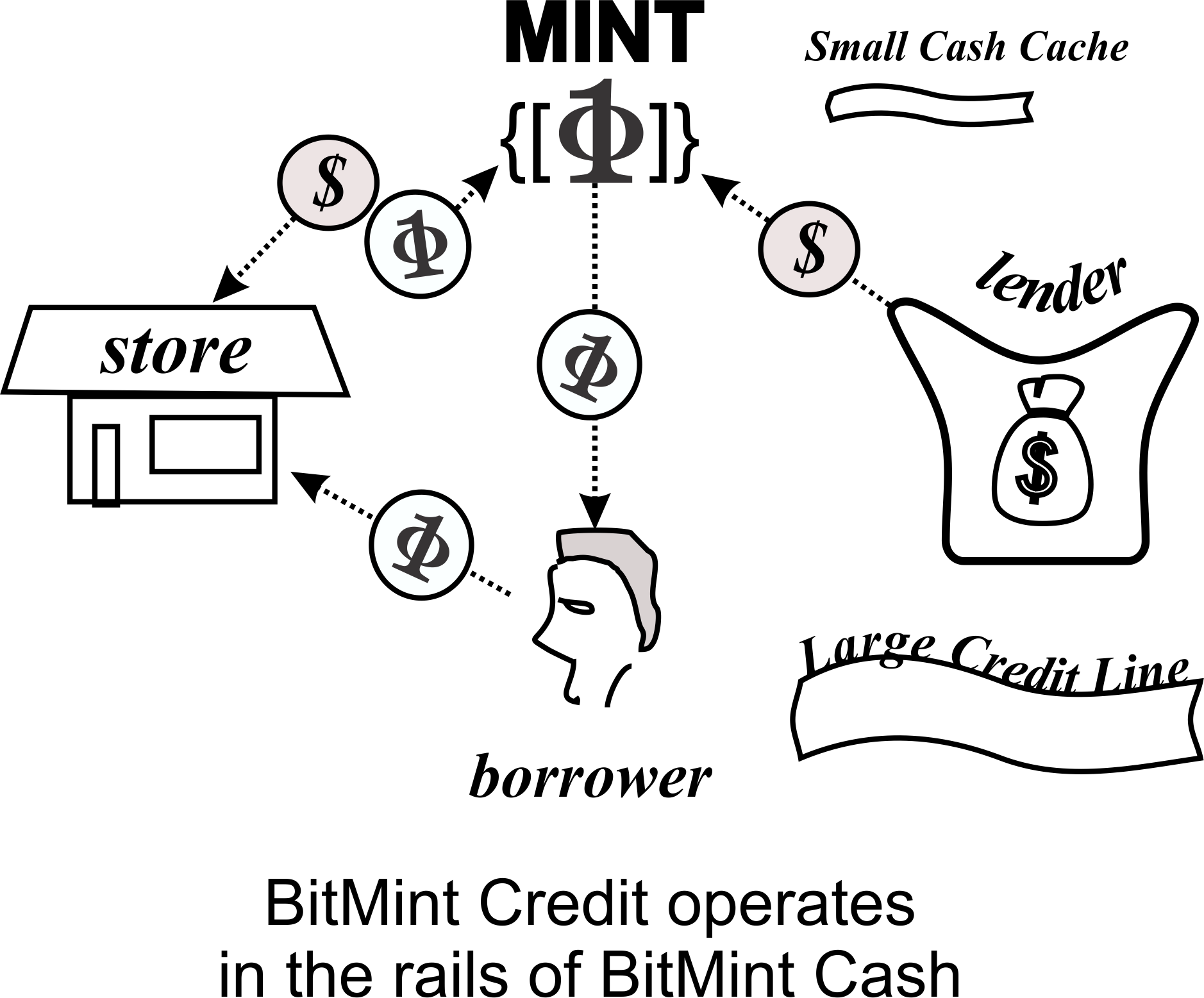

BitMint Consumer CreditConsumer credit is the most dynamic financial market world-wide, dominated by half-a-century old institutions (the payment card companies) who rose to prominence in the pre cyber-world era. Wielding their power these payment mammoths fitfully adjusted to cyber reality, but at a cost of unbecoming complexity. The smallest card transaction today involves beside the payer and the payee, the acquirer bank, the issuer bank, the card payment company, and then the processor, the gateway company, and all the associated regulatory agencies, and the myriad of regulatory compliance firms. Way too much. The genius behind the phenomenal success of Visa, MasterCard, AmExp and their like is the underlying idea of extending commercial line of credit to consumers. Namely, pre-authorizing a loan, which accumulates interest only when actually used. In the 60's of the last century this was a formidable task that required the chain of trust that gave rise to the reigning complexity. But in cyber territory it's all straight forward. China has leapfrogged ahead of the United States. In America the lion share of the almost four trillion dollar consumer credit market is based on payment cards. In China mobile and peer-to-peer lending soared to dominance. The race is on. The market that would first implement frictionless credit flow will prosper first. The players: the lender, the borrower, the merchant, and BitMint. The lender (which does not have to be a bank) comes to identify a good-risk borrower, and extends to her a $5,000 line of credit. To do so, the lender requests BitMint to issue to the borrower $5,000 in BitMint coins which are associated with two valuation functions: one cash, and one debit. The coins may be further tethered to type of goods, or to a window of time etc. The borrower carrying these coins in her phone, decides to make a purchase at the sum of $1,000, so she splits her $5,000 BitMint coin, and "beams" to the merchant a $1,000 worth of BitMint money. (The "beaming" happens via NFC, Bluetooth, WiFi, or through any other channel). The merchant's software recognizes the coin as not plain cash, but as credit (reading the valuation function), so he sends the coin to the BitMint mint for authorization. The BitMint mint recognizes the coin that it issued, it verifies the identity of the borrower, and automatically checks compliance with all the terms of the loan, (as written in the coin itself), and when the coin is cleared, it issues an untethered plain-cash digital coin to the merchant, while debiting the lender's BitMint account for the same amount. By so doing BitMint has in its account the cash to redeem the merchant's untethered coin upon his request. The lender has good statistics to know how much money from the total outstanding lines of credit, will be used for purchases at any given day. If this is 1% of the total authorized credit, then this will be the amount of cash the lender will keep in the account accessible by BitMint to pay the merchant. In parallel to sending the merchant his money, the BitMint mint sends the borrower the purchase amount as debit (negative valuation) coins that specify the term of repayment to the lender. The receipt returned for this negative coins is passed to the lender. No processor, no gateway, no acquirer and no issuer -- BitMint alone facilitates the operation. Anyone can lend, and everyone can borrow, compliant with local law. The interest, the risk are between the lender and the borrower, BitMint assumes no risk, it just collects a service fee.

The full range of payment integrity options used for BitMint cash will also be used for BitMint consumer credit; the full power of BitMint security will be used to prevent credit line fraud. The lender can extend credit to a group, so that members of the group will be able to trade with these credit coins. A merchant will be able to reward its faithful customers with a generous credit line, but limit the money to store purchase. A lender may condition its loan on the borrower being employed with the same company, to hedge its risk -- and BitMint will not pay the merchant without proof of employment. The terms of the loan travel as a trailer along with the value bits of the coin -- the power of BitMint.

|

.

.

.

.